Diminishing value depreciation formula accounting

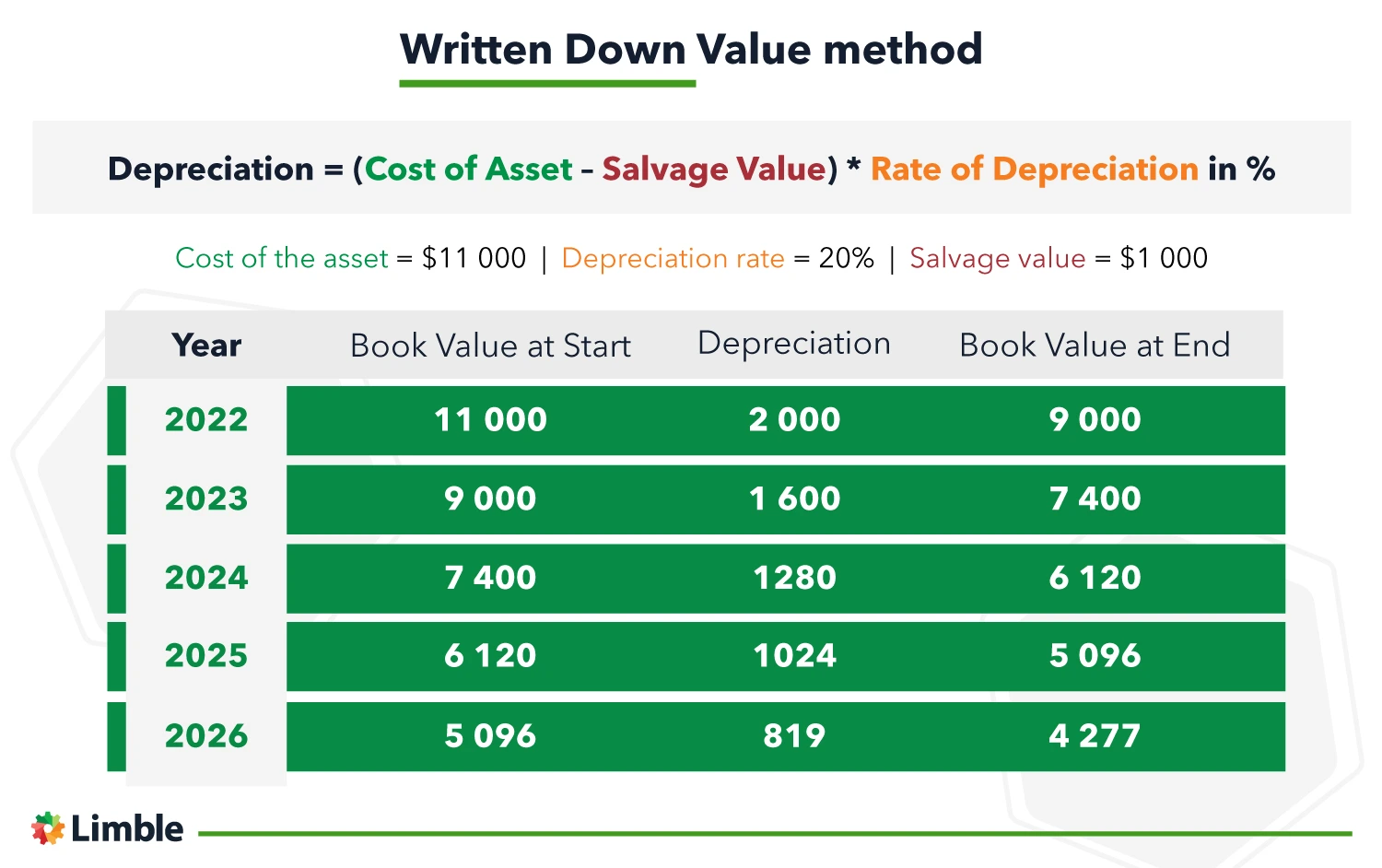

25000 20 5000 Second Year. 80000 365 365 200 5 32000 For subsequent years the base value.

Depreciation Formula Examples With Excel Template

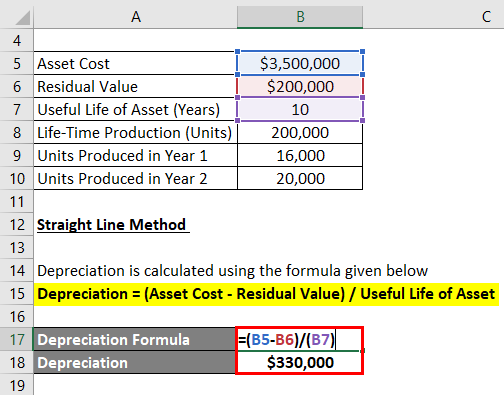

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100.

. Some of the merits of diminishing balance method are as follows. Ad Get Complete Accounting Products From QuickBooks. Base value days held 365 200 assets effective life Days held can be 366 for a leap year.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. 2000 - 500 x 30 percent 450 Year 2. Under this method the value of the asset never.

Get Products For Your Accounting Software Needs. Diminishing balance Method Actual cost of AssetRate of depreciation100 13700020100 Depreciation Amount for 1 st year will be 2740000 Similarly we can. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Deprecation Value 10000 - 1000 10 90000. Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. Ad Get Complete Accounting Products From QuickBooks.

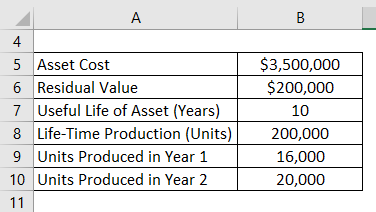

Get Products For Your Accounting Software Needs. TextAmount of depreciation frac textBook Value times textRate of Depreciation 100 2015. Year 1 2000 x 20 400.

SYD The SYD Sum. The diminishing value formula is as follows. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is- Depreciation.

Depreciation amount book value rate of depreciation100. Depreciation 500000 x 10100 x 912 37500 2016. Diminishing Value Depreciation Method.

The rate of depreciation is 60. All new and old assets are mixed with each other for an auditor it is so difficult to differ among them. Hence using the diminishing method calculate the depreciation expenses.

See Note Example 2. That means the submarine is going to depreciate by 80000. In this case we know this amount is 20000.

Year 2 2000 400 1600 x. Depreciation 462500 x. C10 IF SUM C9C912.

If we subtract this value 10 times the asset depreciates from 10000 to 1000 in 10 years see first picture bottom half. Depreciation Rate Book Value Salvage Value x Depreciation Rate The diminishing balance method of. If the asset cost 80000 and has an.

Base value x days held 365 x 200 assets effective life Example. The reducing balance method of depreciation results in declining depreciation expenses with each accounting period. As the book value reduces every year it is also known as the Reducing Balance Method or Written-down Value Method.

It is difficult to calculate optimum rate of depreciation But we can use following formula. Formula or equation for the depreciation calculation may be written as follows. Depreciation expenses Net Book Value.

25000 5000 20 4000 Third Year. The residual value is how much it will be worth at the end of its life. Recognised by income tax.

The formula for the diminishing balance method of depreciation is. For example if the fixed assets useful life is 5 years.

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Formula Examples With Excel Template

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation Basics Accounting For Depreciation Youtube

Depreciation Formula Examples With Excel Template

Written Down Value Method Of Depreciation Calculation

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Calculation

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Equipment Depreciation Basics And Its Role In Asset Management

Depreciation Formula Examples With Excel Template

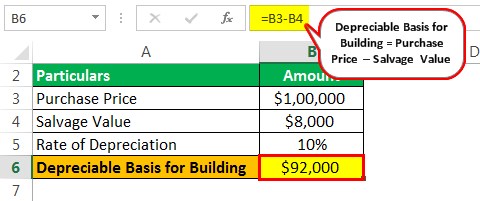

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Examples With Excel Template